Equity refers to an ownership interest such as shares of stock in a corporation, a membership interest in a limited liability company, or a partnership interest in a partnership. Technically, an LLC member has only one membership interest. So it is incorrect to refer in the plural to a member’s “membership interests”. However, a member’s (single) membership interest can be represented by multiple “units”, just as a shareholder’s corporate ownership interest is represented by shares of stock. If membership interests are to be represented by units, it will be provided for in the company’s LLC agreement.

Rights to buy or convert into stock, a membership interest, or a partnership interest are considered contingent equity interests. The most common types of contingent equity are stock options, warrants, and convertible notes. Preferred stock is a form of equity that converts into another class of stock (common) according to certain contingencies.

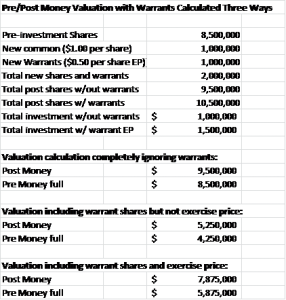

A properly prepared capitalization table will show all contingent equity. See this post explaining what a “fully-diluted capitalization table” is.